Social Security Full Retirement Age Increase and Its Impact on Future Benefits

For millions of Americans, the full retirement age (FRA) for Social Security benefits has long been a key part of their retirement planning. How and when people can claim their Social Security benefits is significantly impacted by the increase in the full retirement age, which has been adjusted continuously over time. Understanding the effects of these changes is more crucial than ever as life expectancy keeps increasing and economic conditions change.

This article will discuss how future benefits, retirement planning techniques, and choices for workers nearing retirement are impacted by the raising of Social Security’s full retirement age.

What Is Full Retirement Age and How Is It Changing?

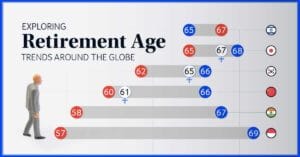

The age at which an individual may initially be eligible for full or unreduced retirement benefits from Social Security is known as the Full Retirement Age (FRA). FRA has gradually increased based on the year of birth since it was first set at 65 due to legislative changes in the 1983 Amendments to the Social Security Act.

Here is a quick summary of how FRA has changed over time:

| Year of Birth | Full Retirement Age (FRA) |

| 1937 or earlier | 65 |

| 1938 | 65 and 2 months |

| 1939 | 65 and 4 months |

| 1940 | 65 and 6 months |

| 1941 | 65 and 8 months |

| 1942 | 65 and 10 months |

| 1943–1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

According to the table, people who were born in 1960 or later are now required to wait until they are 67 years old in order to receive their full Social Security benefits.

Why Was the Full Retirement Age Increased?

Raising FRA wasn’t a haphazard decision. The fact that people are living longer and thus receiving benefits for longer periods of time was a major motivator. The Social Security Trust Fund has been under financial strain as a result of the declining worker-to-retiree ratio.

By gradually increasing the FRA, the government hopes to extend the program’s solvency. It lowers the total lifetime benefits disbursed, especially if people continue to opt for early retirement.

How Does This Increase Affect Your Social Security Benefits?

You can still retire earlier even if the FRA is raised. But doing so will result in a permanent decrease in the monthly benefit amount.

- For instance, your monthly benefit could be lowered by up to 30% if your FRA is 67 and you start receiving benefits at age 62.

- Due to delayed retirement credits, which increase by roughly 8% annually after FRA, waiting until you are 70 years old can boost your benefit.

Although the reality is more complex, this system is intended to be actuarially neutral. Your ideal claiming age depends on a number of factors, including your life expectancy, financial needs, job satisfaction, and health.

Impact on Retirement Planning

Americans must either prepare for longer work lives or make sure their retirement funds can fill in any income gaps as a result of the raising of the full retirement age. This could mean the following to some:

- maintaining health insurance through employer-sponsored insurance after the age of 65 until one becomes eligible for Medicare.

- increasing contributions to retirement accounts such as 401(k)s and IRAs.

- modifying retirement lifestyle expectations.

Furthermore, the expanded FRA regulations make it even more difficult to coordinate when each spouse makes a benefit claim if both are employed.

Effect on Lower-Income and Physically Demanding Occupations

Increasing the FRA has been criticized for disproportionately affecting those in physically demanding occupations. It may be challenging for manual laborers, factory workers, and construction workers to stay employed into their late 60s.

Additionally, workers with lower incomes typically live shorter lives, meaning they receive benefits for fewer years than retirees with higher incomes. The increase in FRA might not feel like a neutral adjustment to these people, but rather like a benefit cut.

Will the Full Retirement Age Increase Again in the Future?

Maybe. Given the anticipated trust fund deficits in the ensuing decades, policymakers are still debating Social Security’s future. Although it is still politically sensitive, raising the FRA once more—possibly above 67—is commonly suggested as a possible remedy.

Future raises might further change Americans’ perspectives on work and retirement, and they would probably be implemented gradually.

Final Thoughts

A change that impacts every worker’s financial future, the increase in the Social Security full retirement age is more than just a policy change. As retirement ages advance, people need to adjust by strengthening their savings plans, improving their planning, and having a clear understanding of how these changes affect their long-term income.

It’s never too early or too late to review your retirement objectives and adjust them in accordance with the most recent Social Security regulations. Instead of depending on antiquated presumptions, the secret is to remain informed and make decisions that are tailored to your particular circumstances.

FAQs

Q1: What is the Social Security full retirement age as of right now?

A: The full retirement age is 67 for people born in 1960 or later. Full retirement ages are lower for those born earlier.

Q2: At age 62, am I still eligible to receive benefits?

A: Yes, but if your FRA is 67, your monthly payments will be permanently lowered by up to 30%.

Q3: Does my benefit increase if I wait until I reach full retirement age?

A: In agreement. For every year you delay filing past your FRA (until you turn 70), your benefit increases by about 8%.

Q4: Will there be insufficient funds for Social Security?

A: Not totally. Payroll taxes will still cover the majority of payments, but benefits may be cut if nothing changes after the trust fund reserves are exhausted.

Q5: What impact does the FRA increase have on spousal benefits?

A: The same age restrictions are in effect. The monthly amount will be lowered if spousal benefits are claimed prior to the FRA.

Q6: Is the FRA increase thought to result in fewer benefits?

A: Yes, in actuality. Most people receive less if they don’t work longer, even though the total benefits might be actuarially fair.

Q7: Should I postpone receiving my Social Security benefits?

A: That depends. Delaying could result in larger monthly payments and more financial security in later years if you’re healthy and have the means to do so.

One Comment